Loan App for Easy Borrowing: A Complete Guide to Smarter Digital Use

In today’s fast-moving digital world, financial needs can arise at any time—medical emergencies, business expenses, education fees, or even unexpected travel costs. Traditional bank loans often involve lengthy paperwork, branch visits, and long approval times. This is where loan apps for easy borrowing have completely transformed the lending ecosystem.

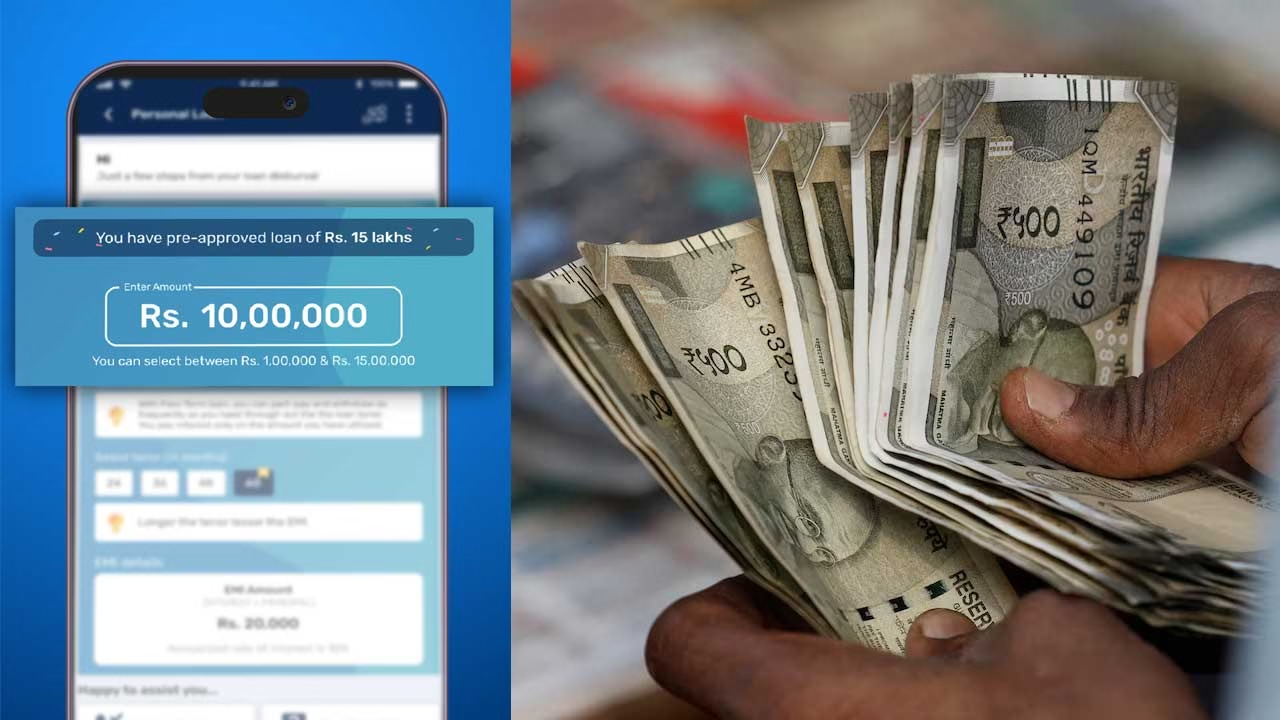

With just a smartphone and internet connection, users can now apply for instant personal loans, check eligibility, and receive funds directly into their bank accounts—sometimes within minutes. This guide explains everything you need to know about loan apps, how they work, their benefits, risks, and tips for smarter digital borrowing.

What Is a Loan App?

A loan app is a mobile-based digital platform that allows users to apply for short-term or long-term loans without visiting a bank. These apps use technology like AI, machine learning, and digital KYC to assess creditworthiness quickly.

Popular loan app categories include:

- Instant personal loan apps

- Salary advance apps

- Business loan apps

- Student loan apps

- BNPL (Buy Now, Pay Later) apps

Loan apps are especially popular among young professionals, self-employed individuals, and small business owners who need fast access to credit.

How Loan Apps Work

Loan apps follow a simple and user-friendly process:

1. App Download & Registration

Users download the app from the Google Play Store or App Store and register using a mobile number.

2. Digital KYC Verification

Most loan apps require:

- Aadhaar card

- PAN card

- Bank account details

eKYC is completed digitally, saving time and paperwork.

3. Eligibility Check

The app evaluates eligibility using:

- Credit score (CIBIL)

- Income details

- Employment status

- Bank transaction history

4. Loan Approval & Disbursal

Once approved, the loan amount is directly credited to the user’s bank account—often within minutes or hours.

Key Benefits of Using Loan Apps

1. Instant Loan Approval

Loan apps provide fast approvals compared to traditional banks, making them ideal for emergencies.

2. Minimal Documentation

Most apps require only basic documents, reducing complexity.

3. Flexible Loan Amounts

Borrow amounts range from ₹1,000 to several lakhs, depending on eligibility.

4. Transparent EMI Options

Users can choose repayment tenure and view EMIs before accepting the loan.

5. 24/7 Availability

Unlike banks, loan apps are accessible anytime, anywhere.

Types of Loans Available on Loan Apps

Personal Loans

Unsecured loans for medical expenses, travel, or daily needs.

Business Loans

Designed for MSMEs and startups to manage working capital.

Instant Cash Loans

Short-term loans with quick repayment cycles.

Student Loans

Some apps offer education-focused loans with lower interest rates.

Salary Advance Loans

Ideal for salaried individuals needing funds before payday.

Interest Rates and Charges

Interest rates on loan apps can vary based on:

- Credit score

- Loan tenure

- Amount borrowed

- Risk profile

Typical charges include:

- Processing fee

- GST

- Late payment penalty

- Bounce charges

⚠️ Always read the loan agreement carefully to understand the total cost of borrowing.

How to Choose the Best Loan App

With hundreds of loan apps available, selecting the right one is crucial.

Check RBI Registration

Always choose apps partnered with RBI-registered NBFCs or banks.

Read User Reviews

Google Play reviews can reveal hidden issues.

Compare Interest Rates

Lower interest rates reduce overall repayment burden.

Data Privacy Policy

Avoid apps that demand unnecessary permissions like contacts or gallery access.

Customer Support

Reliable customer service is important for dispute resolution.

Risks and Precautions When Using Loan Apps

While loan apps are convenient, they also come with risks if misused.

1. High Interest Rates

Some instant loan apps charge higher interest for short tenures.

2. Over-Borrowing

Easy access to credit can lead to debt traps.

3. Fake Loan Apps

Unregistered apps may misuse personal data.

4. Credit Score Impact

Late payments negatively affect your CIBIL score.

🔒 Tip: Borrow only what you can repay comfortably.

Smart Digital Borrowing Tips

- Borrow only for genuine needs

- Compare multiple loan apps before applying

- Repay EMIs on time to improve credit score

- Avoid rolling loans or repeated borrowing

- Keep track of repayment dates

Responsible borrowing builds financial stability and long-term creditworthiness.

Loan Apps vs Traditional Bank Loans

| Feature | Loan Apps | Bank Loans |

|---|---|---|

| Approval Time | Minutes/Hours | Days/Weeks |

| Documentation | Minimal | Extensive |

| Accessibility | 24/7 | Limited |

| Interest Rates | Medium–High | Lower |

| Convenience | Very High | Moderate |

Loan apps are best for short-term financial needs, while banks suit long-term large loans.

Future of Loan Apps in India

The Indian digital lending market is growing rapidly due to:

- Increased smartphone usage

- UPI and digital payments

- Fintech innovation

- Government digital initiatives

AI-based credit scoring and customized loan products will make borrowing even smarter and safer in the future.

Apply Loan

Conclusion

A loan app for easy borrowing is a powerful financial tool when used responsibly. It offers unmatched convenience, speed, and accessibility for individuals and businesses alike. However, users must stay informed, avoid fraudulent apps, and borrow within their repayment capacity.

By choosing the right loan app and following smart borrowing practices, you can meet financial needs efficiently while protecting your credit health. Digital lending is not just about speed—it’s about making smarter financial decisions.